- Topic

12k Popularity

12k Popularity

138k Popularity

915 Popularity

20k Popularity

- Pin

- 🎉 Hey Gate Square friends! Non-stop perks and endless excitement—our hottest posting reward events are ongoing now! The more you post, the more you win. Don’t miss your exclusive goodies! 🚀

🆘 #Gate 2025 Semi-Year Community Gala# | Square Content Creator TOP 10

Only 1 day left! Your favorite creator is one vote away from TOP 10. Interact on Square to earn Votes—boost them and enter the prize draw. Prizes: iPhone 16 Pro Max, Golden Bull sculpture, Futures Vouchers!

Details 👉 https://www.gate.com/activities/community-vote

1️⃣ #Show My Alpha Points# | Share your Alpha points & gains

Post your - 🚀 ETH jumped to $4,600 this morning, up 8.69% in 24h!

Just shy of the $4,891 ATH—think it breaks through?

📍 Follow Gate_Square, vote and drop your reason.

🎁 4 winners split $100 Futures Voucher! - 📢 Exclusive on Gate Square — #PROVE Creative Contest# is Now Live!

CandyDrop × Succinct (PROVE) — Trade to share 200,000 PROVE 👉 https://www.gate.com/announcements/article/46469

Futures Lucky Draw Challenge: Guaranteed 1 PROVE Airdrop per User 👉 https://www.gate.com/announcements/article/46491

🎁 Endless creativity · Rewards keep coming — Post to share 300 PROVE!

📅 Event PeriodAugust 12, 2025, 04:00 – August 17, 2025, 16:00 UTC

📌 How to Participate

1.Publish original content on Gate Square related to PROVE or the above activities (minimum 100 words; any format: analysis, tutorial, creativ - 💙 Gate Square #Gate Blue Challenge# 💙

Show your limitless creativity with Gate Blue!

📅 Event Period

August 11 – 20, 2025

🎯 How to Participate

1. Post your original creation (image / video / hand-drawn art / digital work, etc.) on Gate Square, incorporating Gate’s brand blue or the Gate logo.

2. Include the hashtag #Gate Blue Challenge# in your post title or content.

3. Add a short blessing or message for Gate in your content (e.g., “Wishing Gate Exchange continued success — may the blue shine forever!”).

4. Submissions must be original and comply with community guidelines. Plagiarism or re

[Japan] Real consumption expenditure in July 2025 shows a slowdown but remains in positive territory; while the consumption trend is solid, there is a possibility of a weakening outlook | A clear explanation of important economic indicators of Japan and America | Moneyクリ Money's investment information and media useful for finances

Announcement on August 8, 2025 (Friday) at 14:00

Japan Economy Watchers Survey July 2025

(Others: From the latest family budget survey, commercial activity statistics quick report, consumer trend survey, and consumer activity index)

【1】Results: Consumption trends appear resilient, but overall they are mixed.

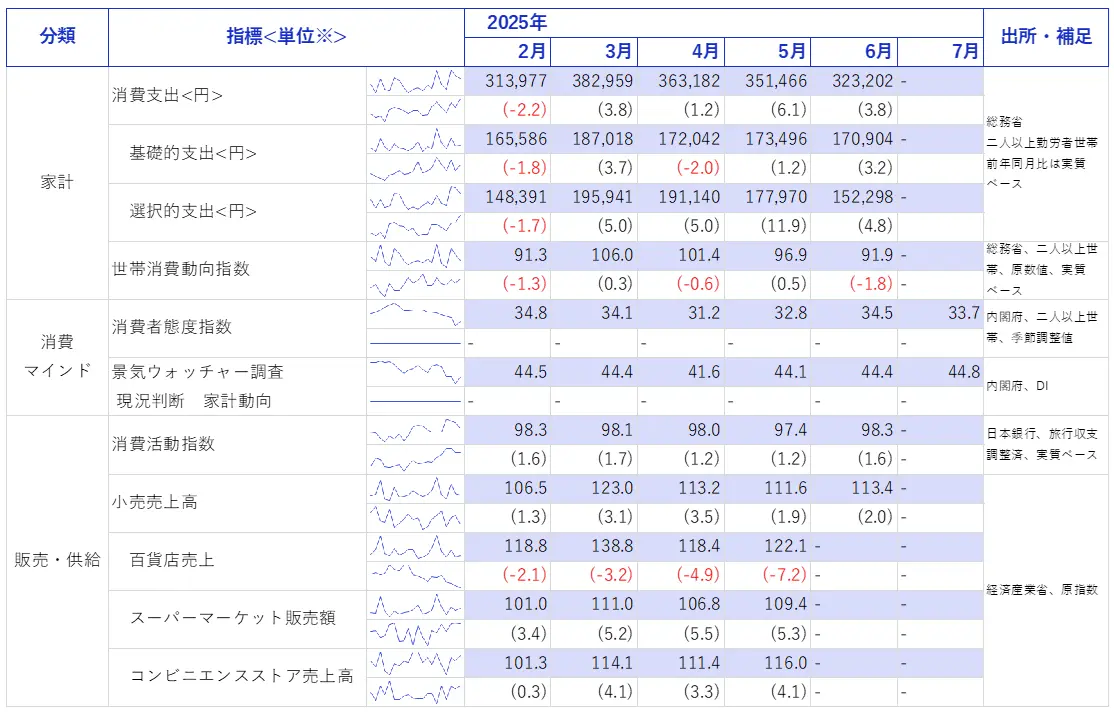

[Figure 1] Recent Consumption-Related Statistics *Items without a supplementary are exponential values, and those in parentheses are year-over-year % comparisons.

Source: Created by Monex Securities from the Ministry of Internal Affairs and Communications, Cabinet Office, Bank of Japan, and Ministry of Economy, Trade and Industry.

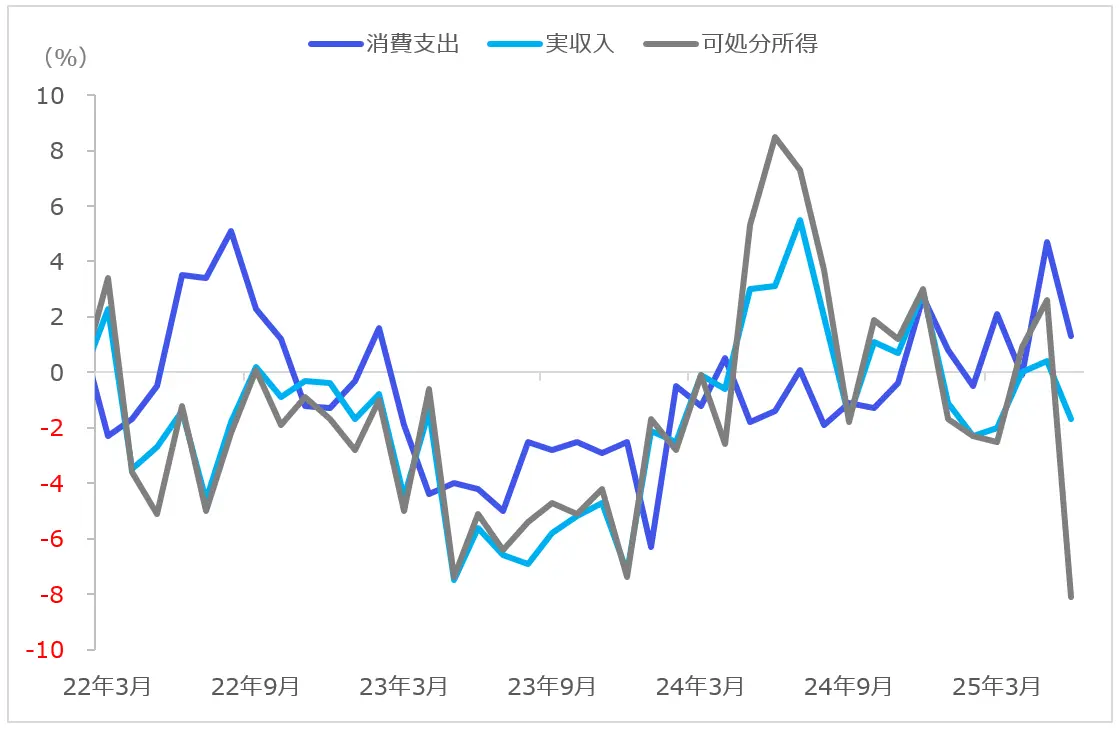

In the household survey of June 2025, the real consumption expenditure of households with two or more workers increased by 3.8% compared to the same month of the previous year, reaching 323,000 yen, marking a positive change for four consecutive months compared to the same period last year. Real income saw a decrease of 1.7% to 976,000 yen, the first decline in three months, attributed to stagnant income growth from bonuses, similar to the monthly labor statistics survey for June released on the 6th. As a result, disposable income (income after deducting taxes and social insurance premiums, commonly known as take-home pay) decreased by 8.1% compared to the same month last year, indicating a slowdown compared to 2024 (Figure 2).

*Items without a supplementary are exponential values, and those in parentheses are year-over-year % comparisons.

Source: Created by Monex Securities from the Ministry of Internal Affairs and Communications, Cabinet Office, Bank of Japan, and Ministry of Economy, Trade and Industry.

In the household survey of June 2025, the real consumption expenditure of households with two or more workers increased by 3.8% compared to the same month of the previous year, reaching 323,000 yen, marking a positive change for four consecutive months compared to the same period last year. Real income saw a decrease of 1.7% to 976,000 yen, the first decline in three months, attributed to stagnant income growth from bonuses, similar to the monthly labor statistics survey for June released on the 6th. As a result, disposable income (income after deducting taxes and social insurance premiums, commonly known as take-home pay) decreased by 8.1% compared to the same month last year, indicating a slowdown compared to 2024 (Figure 2).

Looking at other consumption indicators, retail sales have been maintained at a standstill according to the Ministry of Economy, Trade and Industry, with mixed conditions across industries. While there is a noticeable downward trend in department stores, supermarkets and the like have shown stable sales. Consumer sentiment has remained flat, and while no significant improvement was observed, the outlook for household trends in the Economy Watchers Survey indicated potential for improvement.

[Figure 2] Trends in Income and Consumption of Households with Two or More Employed Persons (Year-on-Year Comparison, %) Source: Created by Monex Securities from the Ministry of Internal Affairs and Communications, all three indicators are on a real basis.

Source: Created by Monex Securities from the Ministry of Internal Affairs and Communications, all three indicators are on a real basis.

【2】Content and Highlights: The private final consumption of GDP in the previous quarter was at best flat.

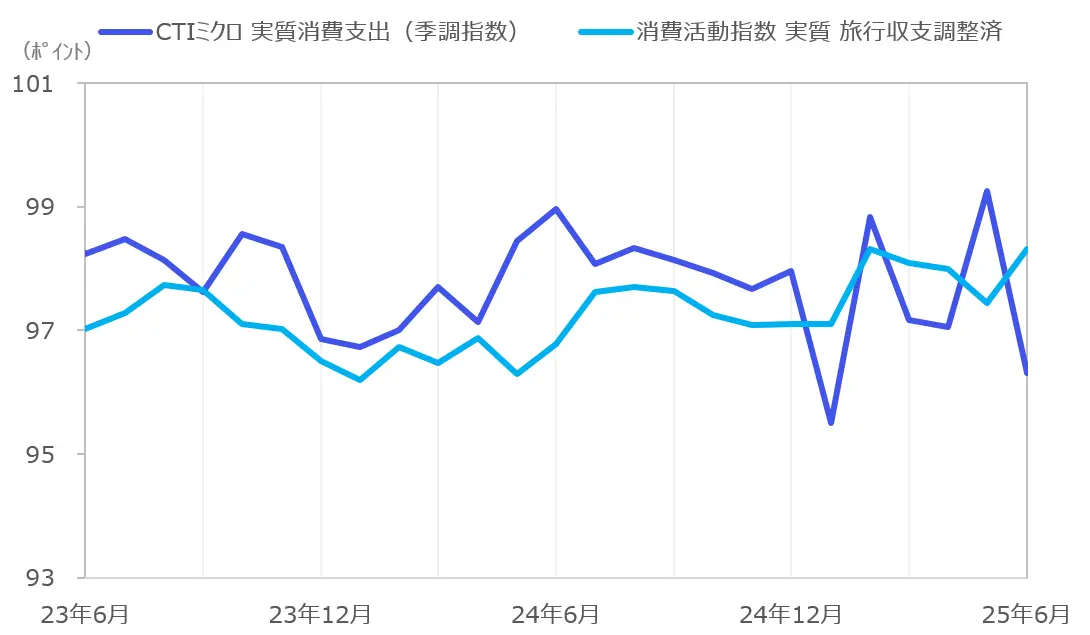

[Table 3] Trends in Household Consumption Trend Index and Consumption Activity Index Source: Created by Monex Securities from the Bank of Japan and the Ministry of Internal Affairs and Communications.

*CTI Micro is for households of two or more people.

The Household Consumption Trend Index, also known as CTI Micro, is an index that represents the "average consumption expenditure amount per household." In June, the seasonally adjusted CTI Micro for households of two or more people decreased by 3.0% compared to the previous month, confirming a decline due to the rebound from a significant increase in May (Figure 3, in blue).

Source: Created by Monex Securities from the Bank of Japan and the Ministry of Internal Affairs and Communications.

*CTI Micro is for households of two or more people.

The Household Consumption Trend Index, also known as CTI Micro, is an index that represents the "average consumption expenditure amount per household." In June, the seasonally adjusted CTI Micro for households of two or more people decreased by 3.0% compared to the previous month, confirming a decline due to the rebound from a significant increase in May (Figure 3, in blue).

On the other hand, although the consumer activity index calculated by the Bank of Japan shows signs of recovery for June, it can be considered as remaining flat when viewed over the previous quarter. From this, personal consumption in the GDP for the previous quarter (April - June 2025) is expected to be flat, with a quarter-on-quarter change of around 0%.

【3】Impressions: For future consumption to gain further strength, an increase in base salary is important.

While there are some signs of weakness in consumption at the moment, it is considered to be steadily transitioning. On the other hand, as shown in Chart 2, there is evidence of concerns for the future, such as a significant decline in real disposable income. It is expected that the domestic economy will face downward pressure on GDP due to a decrease in exports resulting from the U.S. tariff policy, but there is a perspective that consumption will support this, indicating that personal consumption is becoming increasingly important.

However, in cases where households are aware of a decline in income, this scenario may falter. Since bonuses are temporary factors, it is considered important whether the base salary steadily rises.

Monex Securities Financial Intelligence Department Keita Yamaguchi