TangHuaBanzhu

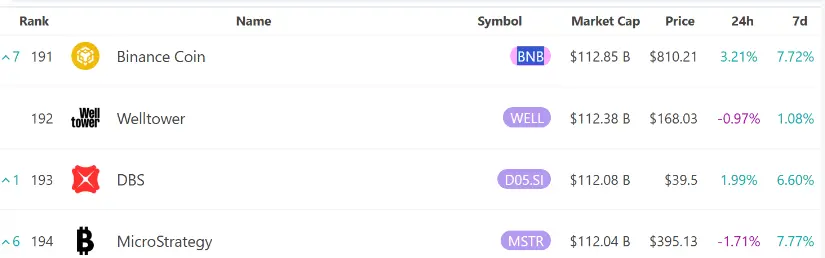

💰NASDAQ-listed company #BNC announced the purchase of 200,000 $BNB, valued at approximately $160 million.

Public company BNB Network Company (NASDAQ: BNC) announced the purchase of 200,000 BNB, with a transaction amount of approximately 160 million USD, making it the largest enterprise-level BNB holding institution globally. The company previously completed a $500 million private placement financing led by 10 X Capital and established #BNB as its primary reserve asset.

{future}(BNBUSDT)

View OriginalPublic company BNB Network Company (NASDAQ: BNC) announced the purchase of 200,000 BNB, with a transaction amount of approximately 160 million USD, making it the largest enterprise-level BNB holding institution globally. The company previously completed a $500 million private placement financing led by 10 X Capital and established #BNB as its primary reserve asset.

{future}(BNBUSDT)