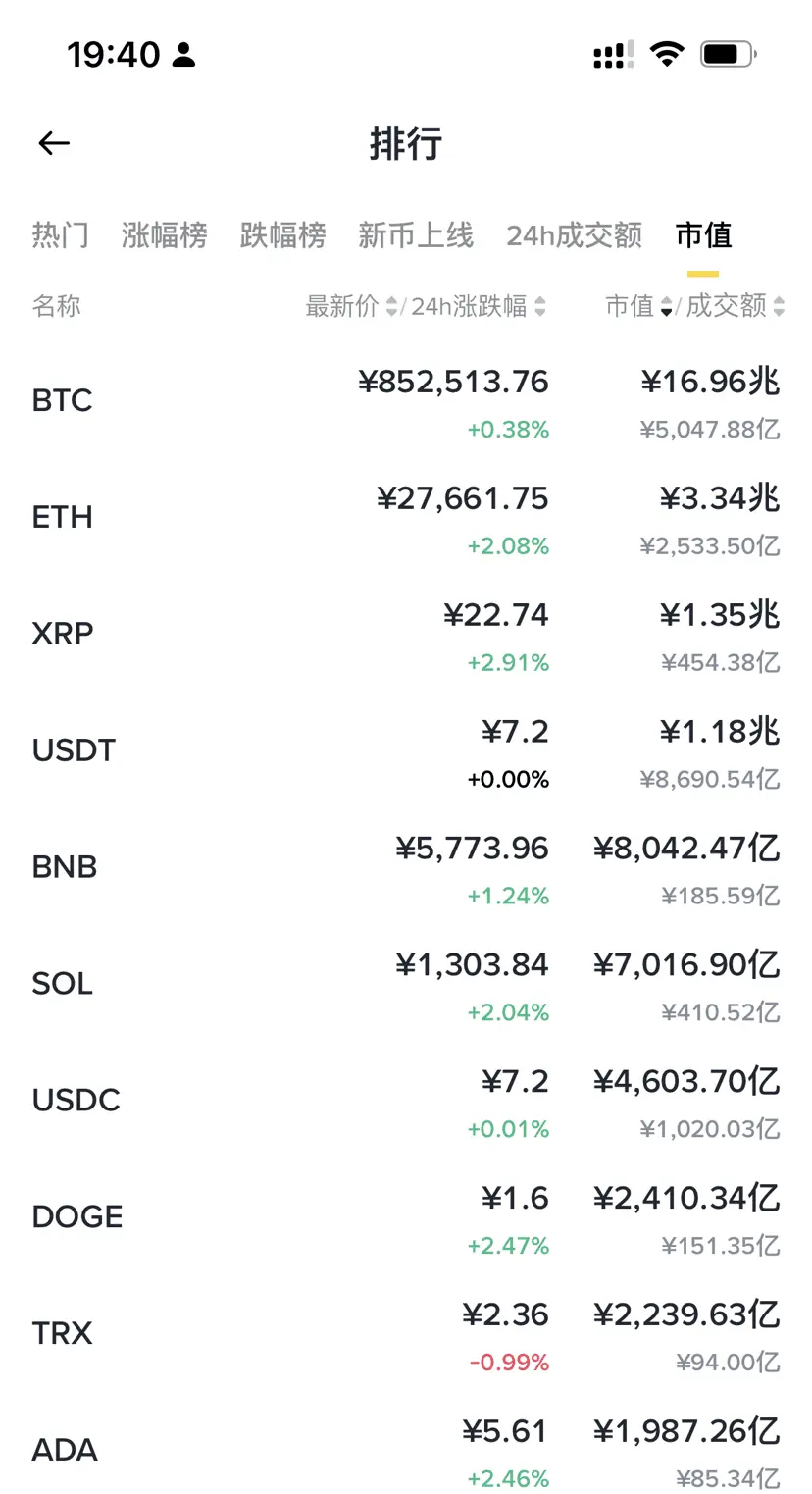

In the Bitcoin market, investors often face complex psychological challenges. When the price of Bitcoin reaches 120,000, many believe that 80,000 to 100,000 is the right buying opportunity. However, when the price actually falls, investors' reactions are often unexpected.

Some people take a wait-and-see attitude, believing that the price will continue to fall, so they are reluctant to enter the market. Others believe that the current price is already suitable and decisively buy in, but they may face the risk of short-term entrapment afterwards.

The dilemma for onlookers is that even if the pri

Some people take a wait-and-see attitude, believing that the price will continue to fall, so they are reluctant to enter the market. Others believe that the current price is already suitable and decisively buy in, but they may face the risk of short-term entrapment afterwards.

The dilemma for onlookers is that even if the pri

BTC-2.76%